draftkings 1099-misc|D R A F T K I N G S I N C : Cebu Forms 1099-MISC and Forms W-2G are expected to be available online at the . The odds are collected from bookmakers that have odds on Eurovision Song Contest 2017. We don't provide any bets on these odds. . Eurovision Song Contest 2023 (closed) Eurovision Song Contest 2022 (closed) Eurovision Song Contest 2021 (closed) Eurovision Song Contest 2020 (cancelled) Eurovision Song Contest 2019 .

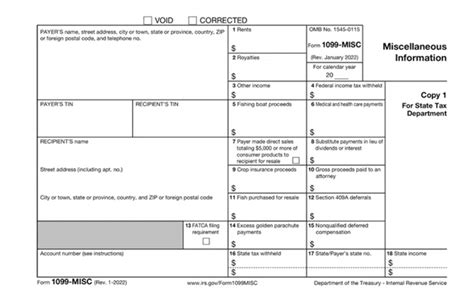

draftkings 1099-misc,If you have greater than $600 of net earnings during a calendar year, you can expect to receive an IRS Form 1099-Misc from DraftKings. This form will include all net earnings .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you .

Forms 1099-MISC and Forms W-2G are expected to be available online at the .Ago 2, 2024 — Learn how to handle taxes on your sports betting income, whether you're a casual bettor or a professional gambler. Find out what taxes you need to pay, how to .If you qualify to receive tax forms from DraftKings (IRS Forms 1099/W-2G), you can access the information directly from the Financial Center. You can expect to receive your tax .Forms 1099-MISC and Forms W-2G are expected to be available online at the end of January 2024. A separate communication will be sent to players receiving tax forms as .

Peb 21, 2024 — Learn how to access your DraftKings tax form 1099 online or by mail if you have won over $600 from sports betting, fantasy sports, or casino games. Find out how to report your winnings and losses on your .Fantasy sports organizers must send both you and the IRS a Form 1099-MISC or 1099-K if you take home a net profit of $600 or more for the year. Fantasy sports organizers use a .

Peb 24, 2024 — If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under .draftkings 1099-misc D R A F T K I N G S I N CMay 31, 2019 — The best place to put this 1099 is under ''Other Common Income''. It can be found in the Wages & Income section, and I have attached a screenshot. After you enter .Peb 18, 2022 — C au ti on ar y S tate me n t R e gar d i n g F or w ar d -L ook i n g S tate me n ts T hi s A nnua l R e port on F orm 10-K (t hi s “ A nnua l R e port ” ) c ont a i ns forw a .Yes, you’ll only be taxed on winnings, and only if it’s $600+ at year end. If so they will send you a 1099, if you don’t get that don’t worry about it.Ene 31, 2024 — This form is similar to the 1099 form and serves as a record of your gambling winnings and as a heads-up to the IRS that you’ve hit the jackpot. You then must report all gambling winnings on your tax return. .

To ensure that DraftKings has the correct information for your tax forms, please visit the DraftKings Tax ID form to confirm or update your details.. Note: Fantasy app customers can update their IRS Form W-9 via desktop, laptop, or mobile web.D R A F T K I N G S I N CIn practice, at least for DFS, DraftKings will send you a 1099-MISC with the amount as your net winnings, but ONLY IF your net winnings are at least $600. Here "net winnings" includes all bonuses etc.. Basically it is .Mar 11, 2023 — For Draftkings Reignmakers "winnings" they send you a 1099 Misc. Entering that # in TurboTax in the "other" income section (where it belongs) doesn't give you an option to select gambling losses to offset the "winnings". There has to be a way to deduct the cost of the contests, otherwise I lost mo.Peb 24, 2024 — If during the year your winnings exceed $600, DraftKings will send you a Form 1099-MISC. As it’s your responsibility to report all income, even earnings under $600 should be declared. However, tax withholding, or the amount directly deducted by DraftKings from your winnings, is only applicable in specific cases. .Receive a 1099-MISC from FanDuel or DraftKings? Got questions about Fantasy Sports, Sports Betting, Gambling and Cryptocurrency Taxes? Then you came to the right place! We’re focused on providing unparalleled, valued added tax and consulting services to the casual and professional Fantasy Sports Player, Sports Bettor, Gambler and .

The information provided on this page doesn’t constitute tax advice and DraftKings advises its customers to consult with a professional when preparing their taxes. Learn more about the IRS's taxable reporting criteria for gambling winnings and IRS Form W-2G used to report income related to gambling.Agree. Speak with tax professional. I never received 1099 from DK or FD on my earnings (not over $600 individually), but I withdrew over $600 over the course of the year, net earnings from both, and received a 1099 from PayPal.Peb 24, 2024 — If you’re a winner and your net profit exceeds $600 in a calendar year, DraftKings will issue you a Form 1099-MISC. This is a standard IRS form used to report miscellaneous income, like non-employee compensation and rewards. Remember, whether or not you receive Form 1099-MISC, all your DraftKings winnings are taxable.

Abr 1, 2024 — To enter a 1099-MISC for miscellaneous income in TurboTax:. Note: If your TurboTax navigation looks different from what’s described here, learn more. Open or continue your return. Select Search, enter 1099-misc and select Jump to1099-misc.. Or go to Wages & Income and select Start next to Form 1099-MISC under Other Common .

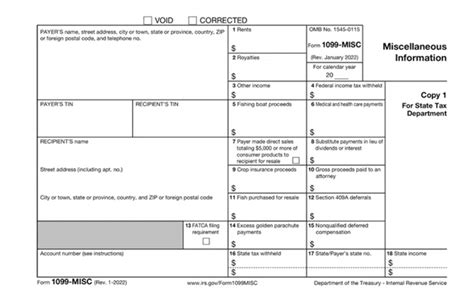

Ago 18, 2024 — The 1099-Misc form has a due date of January 31 (for the previous calendar year) for the issuers and players can expect to receive these by then or shortly thereafter. It would be a good idea when receiving the 1099-Misc that the information contained in the form is reviewed for accuracy like SSN, name, address, and especially the income .

draftkings 1099-miscto continue to DraftKings Daily Fantasy. Email or Username. Remember my username/email. Password. Forgot Password? Log In. Don't have an account? Sign Up. If you or someone you know has a gambling problem and wants help, call 1-800-GAMBLER. You must be 18+ to play (19+ in AL & NE and 21+ in AZ, IA, LA & MA). Account sharing .We would like to show you a description here but the site won’t allow us.

Mar 11, 2024 — Even if you don't receive a 1099 form, you are still required to report all of your income on your federal and state income tax returns. The IRS planned to implement changes to the 1099-K .Ene 18, 2023 — If you are lucky to take home a net profit of $600 or more for the year playing on DraftKings, FanDuel, BetMGM, and other fantasy sports sites, the IRS requires that you report the winnings you earned. Fantasy sports sites and apps must send you (and the IRS) a Form 1099-MISC. In some cases, they will send a W-2G instead.

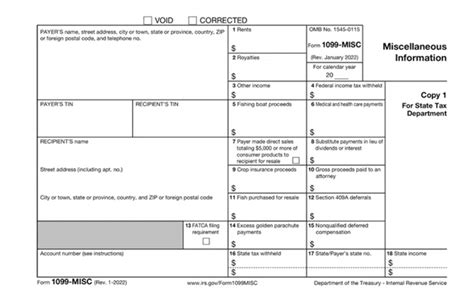

Peb 12, 2018 — If you have winnings of over $600 from any Daily Fantasy Sports site, such as FanDuel or DraftKings, you will likely receive a Form 1099-MISC with the amount shown on Box 3. . Box 3 of the Form 1099-MISC, as opposed to Box 7- Nonemployee Compensation, would suggest that the DFS winnings are a Prize. However, .May 31, 2019 — I received a 1099-Misc of $5,661 from FanDuel and have filed that on my tax return. On Draftkings, I had a yearly loss of $1,300. Can I offset these fantasy sports sites? Announcements. Attend our Ask the Experts event about Self-Employed Quarterly Filing on Aug 28! >> RSVP NOW!

We will withhold federal income tax from the winnings if the winnings minus the wager exceed $5,000 and the winnings are at least 300 times the wager. Form 1099-Misc: We will report prizes and awards that are not for services performed and are not a result of a wager whose aggregate amount is $600 or greater

draftkings 1099-misc|D R A F T K I N G S I N C

PH0 · Where can I find my DraftKings tax forms / documents (1099/ W

PH1 · Where can I find my DraftKings tax forms / documents (1099/ W

PH2 · What are the 1099

PH3 · Understanding Your DraftKings Tax Withholding: Key Strategies and Rul

PH4 · Understanding Your DraftKings Tax Withholding: Key

PH5 · Tax Considerations for Fantasy Sports Fans

PH6 · Started draftkings February 2022. Can someone

PH7 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH8 · Key tax dates for DraftKings

PH9 · I received a 1099

PH10 · DraftKings Tax Form 1099

PH11 · D R A F T K I N G S I N C